Vehicle frame restoration is a specialized insurance segment for classic car repairs, requiring skilled technicians and advanced tools to address structural damage. Insurers use CAD software and 3D scanning for rigorous assessments, ensuring structural integrity and accurate claims processing. Restoration versus replacement depends on damage severity; it's cost-effective and sustainable when feasible within 50-70% of pre-accident value.

In the realm of automotive repairs, Vehicle Frame Restoration (VFR) claims present unique challenges for insurance providers and policyholders alike. This article explores how insurance handles these specialized claims, delving into key aspects like understanding VFR, assessment processes, and restoration vs. replacement decisions. By examining these factors, we aim to provide clarity on navigating vehicle frame restoration coverage, empowering both insureds and insurers with essential insights in today’s digital era.

- Understanding Vehicle Frame Restoration Claims

- The Assessment Process: How Insurance Companies Evaluate Damage

- Restoration vs. Replacement: Deciding on Repair Coverage

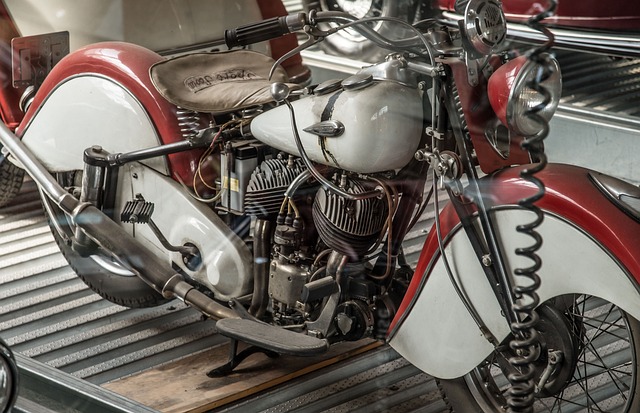

Understanding Vehicle Frame Restoration Claims

Vehicle frame restoration claims are a specialized area within the insurance industry, focusing on repairs to a vehicle’s structural backbone—the frame. These claims often arise from significant accidents or damage to classic cars, which require meticulous attention during the restoration process. In the case of a collision, for instance, the frame can be bent, twisted, or damaged in ways that conventional repair methods may not address effectively.

A collision repair center specializing in vehicle frame restoration is equipped with advanced tools and techniques to handle such complex repairs. These centers employ experienced technicians who understand the intricacies of classic car restoration, ensuring that every part of the frame is accurately measured, replaced, or reinforced. The goal is not merely to fix the visible damage but to bring the entire structure back to its original integrity, thereby safeguarding the vehicle’s safety and value, especially for those cherished classic cars.

The Assessment Process: How Insurance Companies Evaluate Damage

Insurance companies employ a meticulous assessment process to evaluate damage when it comes to vehicle frame restoration. This involves a detailed inspection by trained professionals who scrutinize every aspect of the car’s structure, identifying both visible and hidden damages. They consider factors like the age and condition of the vehicle before the incident, the severity of the collision, and the cost of parts and labor required for repair. Advanced diagnostic tools, including computer-aided design (CAD) software and 3D scanning, are often utilized to pinpoint precise areas of damage and ensure accurate assessments.

The assessment process aims to determine the extent of the vehicle’s structural integrity, which is paramount in cases of frame restoration. Insurance adjusters compare the damaged vehicle with its pre-accident condition, taking into account not only visible dents and scratches but also any misalignments in the frame, suspension systems, and other critical components. This comprehensive evaluation ensures that claims for auto body services, including bumper repair or dent removal, are accurately priced and processed, facilitating a seamless restoration process.

Restoration vs. Replacement: Deciding on Repair Coverage

When a vehicle suffers significant damage, such as in a fender bender or more severe accidents, the decision between restoration and replacement is crucial. Vehicle frame restoration involves repairing and reinforcing the car’s structural components, ensuring it returns to its original strength and safety standards. This process is often preferred when the frame is only slightly damaged, as it allows for preservation of the vehicle’s original parts and value. Auto body repairs focus on fixing visible areas, while frame restoration addresses the underlying structural integrity.

Insurers play a significant role in this decision by offering repair coverage that can include auto body repairs and, in some cases, frame restoration. They assess the extent of damage, comparing it to the cost of replacement parts and labor. If restoration is feasible and costs less than 50-70% of the vehicle’s pre-accident value, insurers may approve this option. This decision not only saves money for both the policyholder and insurer but also contributes to sustainable practices by reducing waste from unnecessary part replacements in car bodywork.

Vehicle frame restoration claims require a meticulous assessment process where insurance companies evaluate damage, comparing restoration costs against replacement values. By understanding this process and the coverage options available, policyholders can make informed decisions regarding repairs. Navigating these steps ensures that repairs are cost-effective and comprehensive, ultimately leading to a restored vehicle with enhanced safety and value in the event of frame damage.