Paintless dent repair (PDR) offers efficient, cost-effective solutions for car damage, minimizing environmental impact and eliminating traditional panel replacement. Insurance covers significant PDR costs, especially for premium brands, restoring vehicles' aesthetic value without substantial out-of-pocket expenses. Effective communication between insureds, providers, and specialized PDR shops ensures policyholders maximize benefits within coverage limits, affording affordable restoration of cars' pre-accident appearance.

In today’s complex healthcare landscape, understanding PDR (Preventive Dental Regression) benefits is crucial for maintaining optimal oral health. This article delves into the comprehensive overview of PDR benefits and highlights the key role insurance plays in protecting individuals’ health and finances. We explore how insurance navigates claims processes to maximize PDR benefit coverage, ensuring folks can access essential dental care without undue financial strain. By understanding these aspects, you’ll be better equipped to harness the full potential of your PDR benefits.

- Understanding PDR Benefits: A Comprehensive Overview

- Insurance's Key Role in Protecting Health and Finances

- Navigating Claims: Maximizing PDR Benefit Coverage

Understanding PDR Benefits: A Comprehensive Overview

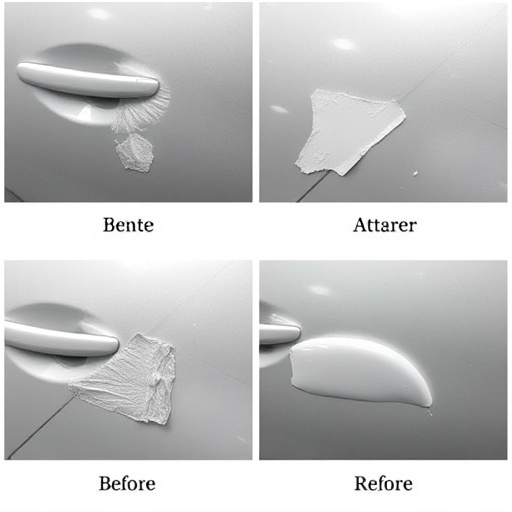

Paintless dent repair (PDR) benefits have gained significant importance in the automotive industry as an efficient and cost-effective solution for car damage repair. PDR is a specialized technique that focuses on removing dents, dings, and creases from vehicle bodies without the need for traditional panel replacement or extensive paintwork. This method has revolutionized car body repair, offering numerous advantages to both repair shops and customers.

By utilizing advanced tools and trained technicians, PDR benefits provide a precise and minimal-impact approach to repairing minor car dents. Unlike conventional methods that can be time-consuming and costly, PDR allows for quick turnaround times and often results in less scrap material generation. This not only reduces costs but also contributes to a more sustainable automotive repair process, minimizing the environmental impact of car damage repair.

Insurance's Key Role in Protecting Health and Finances

Insurance plays a pivotal role in safeguarding individuals’ health and financial stability, especially when it comes to managing unexpected events. In the context of PDR benefits (Paint Damage Repair), insurance acts as a crucial safety net. When a vehicle sustains paint damage due to accidents or other incidents, insurance coverage can help owners navigate the repair process seamlessly. This support is vital, considering that vehicle paint repair, particularly for high-end brands like Mercedes Benz, can be an expensive undertaking.

By offering PDR benefits, insurance providers enable policyholders to access body shop services without incurring substantial costs out of pocket. This not only helps in restoring the vehicle’s aesthetic appeal but also ensures that owners don’t face financial strain during what could otherwise be a stressful situation. Insurance, thus, facilitates quick recovery and peace of mind, allowing individuals to focus on their well-being while leaving complex repairs to professionals.

Navigating Claims: Maximizing PDR Benefit Coverage

Navigating claims processes is an essential aspect of maximizing PDR (Paintless Dent Repair) benefit coverage. Insurance providers offer a safety net for policyholders, ensuring that costs associated with dent repair are covered efficiently. When it comes to PDR, understanding your insurance policy and the specific terms related to cosmetic damage repairs is crucial. Many policies include provisions for auto body repairs, including dent removal, without the need for extensive paintwork. This can result in significant savings for policyholders, as simple dents and scratches that might otherwise require a full repaint can be repaired quickly and cost-effectively through PDR methods.

Effective communication between insured individuals, their insurance providers, and qualified auto body repair shops specializing in PDR is key to success. Policyholders should be aware of their coverage limits and deductibles, ensuring they choose the right repair method for their needs while staying within policy parameters. By combining the benefits of insurance with the precision of PDR techniques, vehicle owners can restore their cars’ pre-accident aesthetic appeal without breaking the bank.

Insurance plays a pivotal role in supporting PDR (Preventive Dental Restoration) benefits, safeguarding both health and finances. By understanding PDR’s comprehensive coverage and effectively navigating claims, individuals can maximize their dental care options while minimizing out-of-pocket expenses. Insurance acts as a shield, ensuring that proactive dental measures are not only encouraged but also financially feasible for all.