Understanding and securing comprehensive auto body shop insurance is vital for business protection in the competitive car repair sector. This includes coverage for property damage, client vehicle liability, and specialized services like frame straightening. Key components like Garage Liability protect against risks within the shop, including medical expenses and legal fees. To find suitable policies, auto body shops should research insurers specializing in their needs, comparing coverage limits, deductibles, and garage liability clauses while assessing insurer reputation for efficient claims handling.

In the competitive landscape of auto repair and restoration, ensuring adequate protection is paramount. Auto body shop insurance that includes garage liability is a cornerstone for businesses aiming to safeguard their operations and assets. This comprehensive coverage protects against potential risks unique to the industry, from property damage to legal liabilities arising from services provided. Understanding the intricacies of such insurance is essential for navigating the complex insurance market and selecting the best fit for your auto body shop.

- Understanding Auto Body Shop Insurance Coverage

- The Importance of Garage Liability in Your Policy

- Navigating Options to Find the Right Insurance for Your Shop

Understanding Auto Body Shop Insurance Coverage

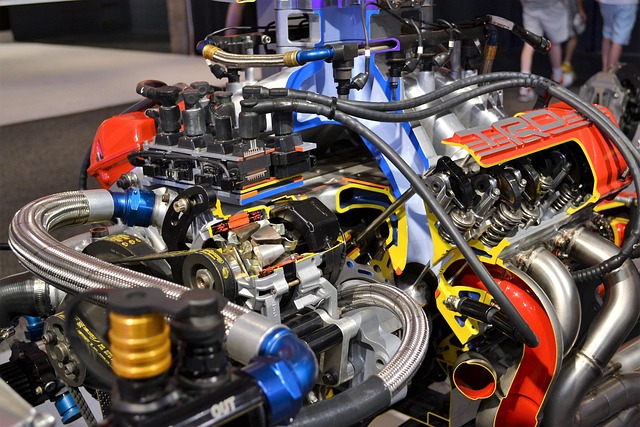

Understanding Auto Body Shop Insurance Coverage is paramount for any business involved in auto body repairs and customization. This type of insurance is designed to protect against financial loss arising from accidents or damages caused while operating a shop, including facilities, equipment, and inventory. Auto body shop owners should opt for policies that cover several key aspects: property damage, liability for accidents involving clients’ vehicles, and the cost of repairing or replacing damaged cars.

A comprehensive auto body shop insurance policy will often include provisions for frame straightening, vehicle dent repair, and other specialized services offered by the shop. It ensures that the business is shielded from financial ruin in case of an accident or damage during these processes, which are integral to modern auto bodywork practices.

The Importance of Garage Liability in Your Policy

In the competitive landscape of auto body shops, having comprehensive insurance is non-negotiable. Among various coverage options, Garage Liability stands out as a crucial component for any business involved in auto body work or vehicle restoration. This type of liability protection is designed to safeguard your shop and its operations against potential risks and claims that may arise within your premises.

Garage Liability specifically addresses accidents or damages caused by operations within your facility, including auto body repair processes. It covers medical expenses, property damage, and legal fees should a client or bystander sustain injuries or experience losses due to your services. By incorporating Garage Liability into your auto body shop insurance policy, you ensure that your business is protected against the financial and legal complexities often associated with vehicle restoration and auto body repair projects.

Navigating Options to Find the Right Insurance for Your Shop

Navigating the world of auto body shop insurance can seem like a daunting task, but with careful consideration and a strategic approach, finding the perfect policy for your business is achievable. The first step is to assess your specific needs and understand the risks associated with operating an auto body shop. This involves evaluating the services you offer, such as auto detailing, vehicle paint repair, or car scratch repair, as each may carry unique liability concerns.

Researching different insurance providers and their offerings is crucial. Compare policies based on coverage limits, deductibles, and specific clauses related to garage liability. Look for providers who specialize in insuring auto body shops, as they are more likely to offer tailored solutions. Additionally, consider the reputation of the insurer and their claims handling process to ensure a smooth experience if and when you need to make a claim.

When choosing auto body shop insurance that includes garage liability, understanding your coverage options is key. By navigating through various policies and providers, you can find the ideal insurance tailored to your specific needs. This ensures comprehensive protection for your business, allowing you to focus on delivering quality repairs without constant worry. Remember, the right auto body shop insurance can be a game-changer in managing risks and fostering long-term success.