Thoroughly review insurance policy before frame repair to understand coverage and limitations. Keep detailed documentation of estimates and receipts for seamless claims process. Maintain open communication with insurer regarding damage, photos, and records for smooth claim resolution.

When filing an insurance claim for frame repair, understanding common pitfalls is crucial. This ensures a smooth process and accurate compensation. In this article, we’ll guide you through three prevalent mistakes to avoid: misinterpreting your insurance policy coverage, submitting inadequate documentation or estimates, and lacking effective communication with insurers. By being aware of these issues, you can navigate the claims process with confidence and receive the appropriate support for your frame repair needs.

- Misunderstanding Insurance Policy Coverage

- Inadequate Documentation and Estimates

- Poor Communication with Insurers

Misunderstanding Insurance Policy Coverage

Many individuals file insurance claims for frame repair assuming their policy will fully cover the cost. However, a common pitfall is misunderstanding what is actually covered under your specific plan. Insurance policies can vary greatly in terms of deductibles, coverage limits, and exclusions, especially when it comes to structural repairs like frame straightening or fender repair. Some policies may only offer limited coverage for these types of damages, while others might not cover them at all. It’s crucial to read and understand your policy details before initiating any auto body repair work.

To avoid disappointment and potential financial strain, take the time to review your insurance policy. Check if frame repair is included in your coverage and familiarize yourself with any conditions or limitations. This will ensure a smoother process when filing an insurance claim for these types of repairs, allowing you to focus on getting your vehicle back to its pre-accident condition without unexpected cost hurdles.

Inadequate Documentation and Estimates

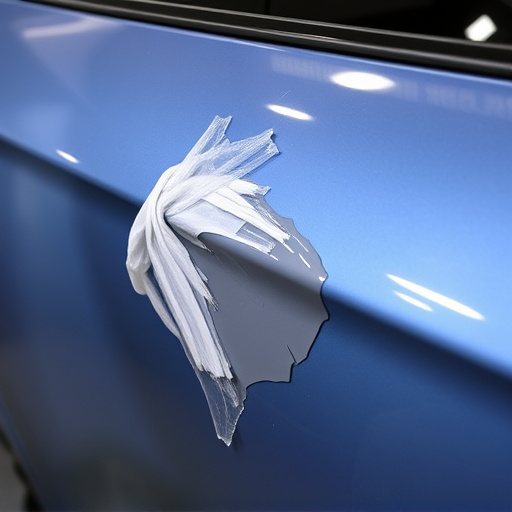

Inadequate documentation is a frequent pitfall when it comes to frame repair for insurance claims. It’s crucial to maintain detailed records of all work performed, parts replaced, and costs incurred. Insurance companies rely on accurate estimates and valid receipts as proof of necessary repairs. Without proper documentation, the claim process can be delayed or even denied, leading to further inconvenience and financial strain.

For instance, consider a scenario where a Mercedes Benz collision repair is required. The shop should provide a comprehensive estimate outlining the damage, the parts needed (including any specialized auto glass replacement), and the labor costs. This documentation not only facilitates smoother insurance claim processing but also ensures the customer receives fair compensation for all necessary auto body repairs.

Poor Communication with Insurers

When dealing with frame repair for insurance claims, poor communication with insurers is a common pitfall that can lead to delays and complications. Many policyholders are unaware of the specific requirements and documentation needed by their insurance companies when filing a claim. Effective communication involves clearly understanding what your insurer needs, providing all necessary details about the vehicle’s damage, and adhering to their submission guidelines. Failure to do so may result in claims being denied or delayed, causing further stress for both the policyholder and the repair shop.

To ensure smooth sailing during the frame repair process, it’s crucial to maintain open lines of communication with your insurer. This includes promptly reporting the incident, taking detailed photos of the damage, and keeping records of all conversations and correspondence. Engaging directly with your insurance representative can help clarify expectations and ensure that everyone is on the same page regarding the frame repair for insurance claim. Remember, clear and timely communication is key to a successful claim resolution.

When undertaking frame repair for insurance claims, avoiding common mistakes is key to a smooth process. Misunderstandings about policy coverage can be rectified by thoroughly reviewing your policy and seeking clarification from your insurer. Inadequate documentation and estimates often lead to delays; ensure you provide detailed, accurate information from the start. Effective communication with insurers, including prompt reporting and clear updates, enhances collaboration and expedites claim settlement. By adhering to these principles, you can navigate frame repair for insurance claims more efficiently.