Frame repair for insurance claims is a critical process that ensures vehicle structural integrity after accidents. Insurance companies closely examine these costs, which can impact policy premiums. The initial step involves damage assessment leading to either replacement or repair decisions. Cost-effective methods like paintless dent repair are preferred, benefiting both insurers and policyholders by reducing premium adjustments. Selecting reputable shops with certified technicians specializing in car collision repair is key for quality and cost efficiency. Proactive vehicle maintenance through regular checks and timely service can also lower insurance costs by preventing extensive future repairs.

Frame repair for insurance can significantly impact your policy premiums. This article delves into the intricate relationship between structural damage and insurance claims, offering insights on how insurance companies handle frame repair costs. We’ll explore effective tips to minimize premiums while ensuring quality repairs, helping you navigate the process with confidence. Understanding these factors is crucial in managing your financial burden post-accidents.

- Understanding Frame Repair and Its Impact on Insurance Claims

- How Insurance Companies Handle Frame Repair Costs

- Tips to Minimize Premiums While Ensuring Quality Repairs

Understanding Frame Repair and Its Impact on Insurance Claims

When it comes to insurance claims for vehicle damage, especially those involving the car frame, understanding the process and its implications is crucial. Frame repair for insurance purposes refers to the restoration of a vehicle’s structural integrity after an accident or damage. This often includes straightening bent frames, replacing damaged components, and ensuring proper alignment to maintain safety standards. The impact on your policy premiums can be significant due to the complex nature of these repairs.

Automotive repair facilities specializing in frame repairs work meticulously to assess the extent of the damage. They use advanced techniques and tools to realign the frame, which is a critical step in ensuring the vehicle’s overall structural integrity and safety during future driving. While collision repair shops offer essential services for all types of vehicle damage, including autobody repairs, frame restoration requires specialized knowledge and equipment. This level of expertise influences the cost of insurance claims, potentially impacting policyholders’ premiums based on the complexity and severity of the frame repair required.

How Insurance Companies Handle Frame Repair Costs

When it comes to frame repair for insurance claims, insurance companies take a keen interest in the costs involved. These expenses are often a significant factor in determining policy premiums. The process typically begins with an assessment of the damage, followed by a decision on whether to replace or repair the vehicle’s frame. If a replacement is deemed necessary, insurers will usually cover the cost but may increase premiums moving forward.

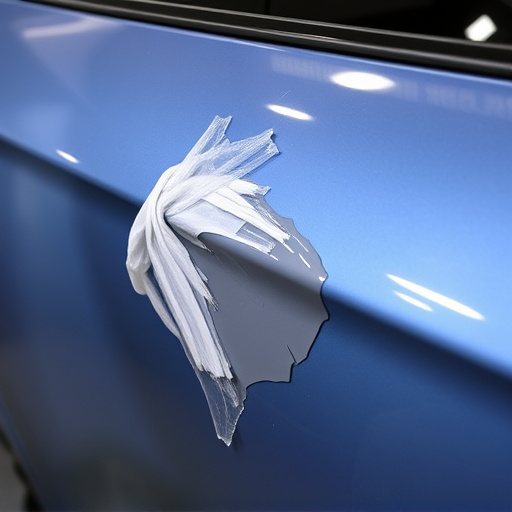

In many cases, insurance companies prefer cost-effective solutions like paintless dent repair for fenders and other minor cosmetic damages. This method preserves the vehicle’s original finish and structure, reducing labor costs compared to traditional frame straightening or complete body repairs. As a result, policyholders might experience lower premium adjustments after such repairs, making it an attractive option for both parties in the frame repair for insurance process.

Tips to Minimize Premiums While Ensuring Quality Repairs

When dealing with frame repair for insurance claims, it’s important to balance quality repairs with cost-conscious decisions to minimize premiums. One effective strategy is to choose reputable shops offering high-quality automotive body work. Certified technicians and shops specialized in car collision repair can ensure precise and efficient work, reducing the need for future repairs and thus lowering premium costs.

Additionally, staying proactive in maintaining your vehicle can significantly impact your policy costs. Regular checks for potential issues, timely service for minor repairs, and following manufacturer recommendations for maintenance can all contribute to minimizing damage down the line. Leveraging these tips allows you to navigate frame repair processes while keeping insurance premiums as affordable as possible through smart, preventative measures and quality automotive repair services.

Frame repair for insurance claims significantly influences policy premiums. By understanding how insurance companies handle these costs and implementing tips to minimize premiums, you can ensure quality repairs without financial burden. Remember, proactive measures in managing frame repair can lead to more affordable insurance policies in the long run.