Understanding your auto insurance policy is crucial for seamless frame repair claims. Policies often cover frame repair under comprehensive or collision coverage, but terms vary. Meticulous documentation is key throughout the process, ensuring transparency, traceability, and accurate assessments. Policyholders should collect detailed damage photos, keep records of shop interactions, and document all communications with insurers and mechanics to streamline claims and ensure proper repairs for optimal vehicle safety and longevity.

When dealing with frame repair for insurance claims, understanding the coverage and importance of detailed documentation is crucial. This comprehensive guide explores how to navigate the process effectively. From comprehending your policy’s terms to preparing meticulous records, you’ll learn essential tips for ensuring a smooth claim. By mastering these steps, you can streamline the often complex journey of frame repair, maximizing your insurance benefits and restoring peace of mind.

- Understanding Insurance Coverage for Frame Repair

- The Importance of Detailed Documentation in Frame Repair Claims

- Navigating the Process: Tips for Effective Frame Repair Documentation

Understanding Insurance Coverage for Frame Repair

When it comes to frame repair for insurance claims, understanding your coverage is crucial. Many standard auto insurance policies include provisions for frame repair as part of comprehensive or collision repair services. This means that if your vehicle experiences damage due to a car collision or other incidents, the insurance company will often cover the costs associated with repairing or replacing the vehicle’s frame.

However, the specifics can vary greatly between insurers and policy types. It’s important to review your policy documents carefully to understand what’s included in your frame repair coverage. Some policies might have deductibles or specific conditions for claiming, such as requiring professional appraisals or adhering to certain safety standards during vehicle restoration. Knowing these details will help ensure a smooth process when filing claims for frame repair services.

The Importance of Detailed Documentation in Frame Repair Claims

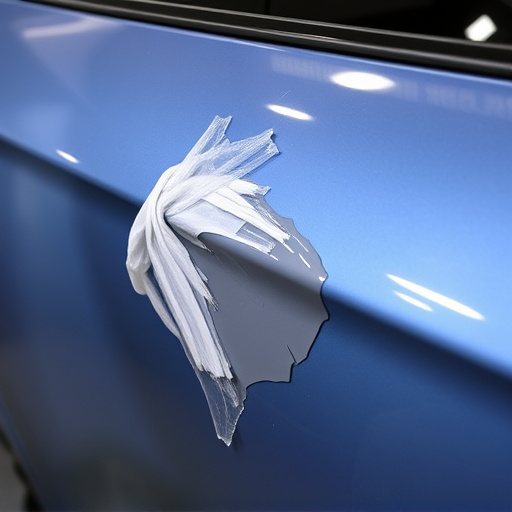

In the realm of frame repair for insurance claims, detailed documentation is paramount. It serves as a bridge between the damaged vehicle and its restoration, ensuring every step of the repair process is transparent and traceable. When filing an insurance claim for frame repair, whether it’s due to an accident or damage over time, thorough documentation can significantly expedite the claim settlement process. This includes not just before-and-after photos but also detailed reports from certified mechanics outlining the extent of the damage and the specific work required.

Accurate records of parts replacement, paint matching, and body panel alignment are crucial for verifying the quality of the repair. For instance, while car dent repair or car paint repair might be apparent, ensuring that the vehicle’s frame is properly aligned and strengthened post-repair is essential for safety and long-term performance. Detailed documentation not only helps insurance providers assess claims accurately but also guarantees that the repaired vehicle meets industry standards for vehicle bodywork.

Navigating the Process: Tips for Effective Frame Repair Documentation

Navigating the process of frame repair for insurance claims requires careful and detailed documentation. As a policyholder, it’s crucial to understand what’s expected of you from the outset. Start by gathering all relevant information about the damage, including photographs of the vehicle from various angles, before any repairs are made. These visual aids will not only help in communicating the extent of the issue to your insurance company but also serve as a reference point for future discussions or disputes.

Next, maintain meticulous records of every interaction with your auto repair shop. This includes detailed estimates outlining the proposed frame repair work, cost breakdowns, and timelines. Additionally, keep track of all correspondence—emails, letters, and phone calls—with your insurance provider and the mechanic. Ensuring comprehensive and accurate documentation throughout this process can streamline claims processing and potentially prevent misunderstandings or delays in getting your car back on the road after repairs are completed, whether it involves intricate auto body painting or more straightforward frame adjustments.

When it comes to frame repair for insurance, detailed documentation is key. Understanding your coverage and navigating the claims process effectively can ensure a smoother journey towards restoring your vehicle. Remember, thorough documentation not only facilitates faster approvals but also protects your interests in case of any disputes. By following the tips provided, you’ll be well-equipped to manage your frame repair claims efficiently.