Vehicle frame inspection data from advanced scanning technology gives insurance companies critical insights into structural integrity, revealing hidden damage for accurate claim assessments. This process leverages 3D scanning and specialized software to analyze chassis, suspension, and body panels, verifying repairs and determining costs. Insurers use this data to enhance safety, develop risk assessment models for fair premium rates, streamline claims processing, and offer tailored coverage options like car paint repair or frame straightening, ultimately benefiting both insured individuals and companies.

Insurance companies are leveraging powerful insights from vehicle frame inspection data to transform claims assessment. By analyzing detailed information about a car’s structural integrity, they can make more accurate damage evaluations, reduce fraud, and streamline the claims process. This data-driven approach not only enhances efficiency but also fosters safety by identifying potential risks and ensuring repairs meet industry standards. Understanding and utilizing vehicle frame inspection data is becoming a key differentiator in the insurance sector.

- Understanding Vehicle Frame Inspection Data

- The Role of Data in Insurance Claims Assessment

- Enhancing Safety and Efficiency through Analysis

Understanding Vehicle Frame Inspection Data

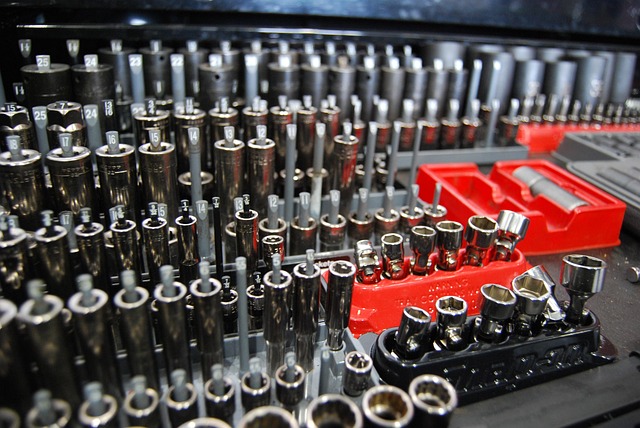

Vehicle frame inspection data offers a wealth of insights for insurance companies, providing a detailed look into the structural integrity of vehicles involved in accidents. This data is gathered through sophisticated scanning technology and precise measurements, revealing hidden damage that may not be immediately apparent to the naked eye. By analyzing this information, insurers can accurately assess the extent of vehicle damage, enabling them to make informed decisions regarding claim approvals, settlement offers, and the overall claims process.

Understanding the nuances of vehicle frame inspection data is crucial for insurance professionals as it facilitates a more efficient and accurate evaluation of collision-related damages. This, in turn, benefits both insured individuals and the insurance companies themselves by streamlining the claims process, reducing fraudulent activities, and ensuring that vehicle repair services are performed to the highest standards at reputable automotive body shops.

The Role of Data in Insurance Claims Assessment

In the realm of insurance claims assessment, data plays a pivotal role, especially when it comes to vehicle frame inspections. These detailed evaluations provide a comprehensive overview of a car’s structural integrity, which is crucial in accurately determining the extent of damage and the associated repair costs. By analyzing data from vehicle frame inspections, insurance companies can make informed decisions, ensuring fair compensation for policyholders.

The process involves examining various components, such as the chassis, suspension systems, and body panels, to identify any deformities or discrepancies. Modern auto body shops often employ advanced technology, including 3D scanning and specialized software, to capture precise data during these inspections. This data not only aids in identifying damage but also helps in comparing pre-and post-accident conditions, ultimately supporting the assessment of repair claims. Additionally, it facilitates the verification of repairs, ensuring that tire services and car body shop interventions are carried out correctly and efficiently.

Enhancing Safety and Efficiency through Analysis

Insurance companies are leveraging vehicle frame inspection data to significantly enhance both safety and efficiency in their operations. By analyzing information gathered from thorough inspections, insurers can identify patterns and trends related to common vehicle damage, particularly after accidents. This enables them to develop more precise risk assessment models, which, in turn, help in setting fairer premium rates. For instance, understanding the frequency of certain types of frame damage, such as those resulting from rear-end collisions, allows insurance providers to offer specialized coverage options tailored to high-risk scenarios.

Moreover, advanced analysis of vehicle frame inspection data supports efficient claim processing. The insights derived from this data facilitate faster decision-making processes, ensuring that claims are settled promptly. This is particularly beneficial in the event of extensive repairs, including car paint repair or frame straightening, where accurate assessments are crucial for both customer satisfaction and maintaining a competitive market position. Car body restoration, for instance, can be more effectively managed when underwriters have access to detailed historical data on similar vehicle models and their subsequent rehabilitation outcomes.

Insurance companies leverage vehicle frame inspection data as a powerful tool for risk assessment and claims management. By analyzing this information, they can streamline processes, enhance safety measures, and provide more accurate pricing. Vehicle frame inspections offer insights into vehicle condition, helping insurers predict potential repair costs and reduce fraud. This data-driven approach not only improves efficiency but also contributes to safer roads by encouraging responsible driving habits and ensuring proper vehicle maintenance.